Every giving decision is an opportunity to join God in the story he’s writing through your generosity—this year and beyond. As we enter the holiday season, there are many ways you can fulfill your goals to be generous.

I’ve learned from working alongside my colleagues at the National Christian Foundation (NCF) that most people do their giving from cash, even though as much as 90 percent of their wealth may be tied up in their assets—such as business interests, stocks, or real estate.

Most charities accept donations of publicly traded stocks that have appreciated in value. In addition, some public charities, like NCF, are also able to accept other assets, such as real estate or business interests, which, upon liquidation, can fund a donor-advised fund (DAF).

What is a DAF? At NCF, we call it a Giving Fund, a simple, flexible solution for personal giving. Specifically, a DAF is a giving account established at a public charity that allows givers to qualify for an immediate tax deduction and support charitable organizations of their choosing. After your tax-deductible donations are made available in your DAF, you can go online to recommend grants to your favorite causes. (Note that once the money is in a DAF, it can only be used to fund giving to public charities in good standing.)

In this season, learning how to give assets, instead of cash, may be helpful. We often come alongside givers and their advisors who are exploring ways to give more through assets like the ones below.

1. Stocks

The last two years have been volatile for the stock market. But if you still have appreciated publicly traded securities or mutual funds (that you’ve held for more than one year) in a taxable investment portfolio, you likely have a significant opportunity to donate more and simplify your giving.

Most people do their giving from cash, even though as much as 90 percent of their wealth may be tied up in their assets—such as business interests, stocks, or real estate.

The key is to donate these appreciated securities before a sale, which means you’ll potentially reduce or eliminate capital gains taxes on the donated securities. You can donate stocks directly to your favorite charity or you can donate them to a DAF and support several charities.

2. Real Estate

If you’re looking for a way to meet a giving goal, you may be able to give commercial, residential, or undeveloped property. When it produces rental income, or when it sells, the net proceeds go into your DAF, so you can help provide food for the hungry, care for orphans, funding for Christian media, support for missionaries bringing the gospel to the ends of the earth, or donations to any other charitable cause you sense God calling you to support.

Giving interests in appreciated real estate prior to any potential future sale is a strategy that may potentially reduce capital gains taxes on the gifted portion. You’ll also likely receive an income tax deduction for the fair market value of the gift, freeing up additional cash flow for more giving.

3. Business Interests

Many business owners have a heart to give more to charity but feel their ability to donate is hindered by their limited cash. If you own a company, you may want to consider donating some interest in your business so future net income can flow through to charity from the business income.

Business owners who are considering selling may also be able to maximize their giving by contributing some of their business interest to charity before pursuing a sale of the company. When business units or shares are contributed to a DAF or other public charity, the fair market value of the gift is usually deductible. Contrasted with a gift of proceeds after liquidation, a gift of appreciated business interest can maximize the amount you’re able to give. Since each situation is unique, business owners should always consult with their tax and financial advisors prior to making this type of gift.

4. Retirement Assets

An IRA owner who turned 70½ before January 1, 2020, or who turns 72 after that date is required to distribute a certain portion of his or her IRA every year. This is known as a required minimum distribution. You can satisfy this requirement by making regular distributions, or you can make a qualified charitable distribution (or QCD), which means using your IRA for giving directly to charity.

If you have more than you need in your IRA, you may choose to make a QCD, which lets you give to charity without having to include the distribution in your adjusted gross income (AGI). This means there are fewer ramifications for other taxes. A QCD is not a deductible gift, so it isn’t limited to 60 percent of your AGI, and you don’t have to itemize your deductions in order to get the tax benefit of the gift. Depending on your goals, you can even make both a QCD and a regular distribution, followed by a deductible gift, in the same year.

Not 70½ yet? Learn how it works, according to your age, and check with your advisors before making a decision to give from your retirement.

5. Testamentary Giving

You can continue to give to your charities after your death. Naming your charity as the beneficiary of all or a portion of your estate through a will, trust, insurance policy, or retirement plan is a strategic way for you to give beyond your lifetime. Testamentary charitable giving allows you to continue funding your giving goals while also potentially reducing the burden of estate tax.

Giving with Joy

Giving noncash assets is a powerful way to expand your giving capacity, enjoy potentially significant tax savings, and provide more support to the causes you care about. It’s also a way to honor the Lord (Prov. 3:9), reflecting his generosity to us (1 Chron. 29:14) and obeying his command to provide for the needy (Prov. 19:17).

It’s a delight to be able to do these things (2 Cor. 9:7). So make the most of what you have to give by leveraging your noncash assets for God’s purposes.

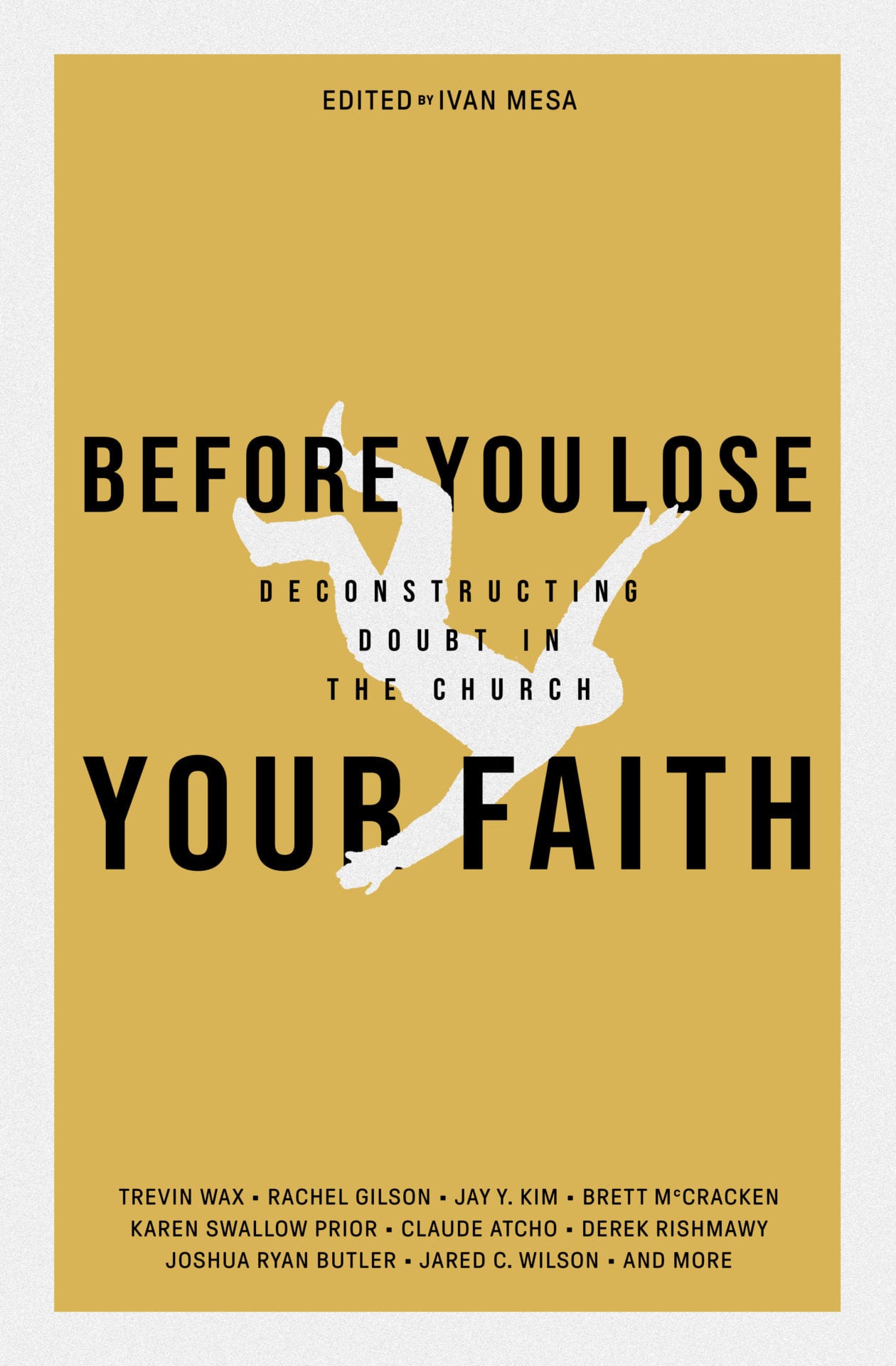

Free Book by TGC: ‘Before You Lose Your Faith’

Many young people are walking away from Christianity—for reasons ranging from the church’s stance on sexual morality, to its approach to science and the Bible, to its perceived silence on racial justice.

Many young people are walking away from Christianity—for reasons ranging from the church’s stance on sexual morality, to its approach to science and the Bible, to its perceived silence on racial justice.

TGC’s book Before You Lose Your Faith: Deconstructing Doubt in the Church is an infusion of hope, clarity, and wisdom in an age of mounting cynicism toward Christianity.

For anyone entering college or the workplace and looking for a timely reminder of why Christianity is good news in a skeptical age, make sure to get your FREE ebook Before You Lose Your Faith today!